Preparing a Power of Attorney

| This information applies to British Columbia, Canada. Last reviewed for legal accuracy by Kevin Smith in March 2017. |

A power of attorney is a legal document in which you authorize another person to take care of financial and legal matters for you. It is one of several options for “personal planning”, which involves making arrangements for while you are alive but may need assistance.

Learn how a power of attorney can be a simple and inexpensive way to arrange help with your financial and legal affairs.

What a power of attorney allows you to do

A power of attorney is a legal document. When you make a power of attorney, you give someone the authority to take care of financial and legal matters for you. This might include paying bills, depositing or withdrawing money from your bank account, investing your money, or selling your home.

The person you give this power to is called the attorney. (In this case, attorney does not mean lawyer.)

You are called the adult.

A power of attorney does not give the attorney authority to make decisions about your personal care or health care. It covers financial and legal matters only.

A power of attorney is different from a will, which provides for the distribution of the things you own after your death. A power of attorney is a way to plan for the handling of your affairs during your lifetime.

It can help if you physically can't take care of matters

There are several reasons you might make a power of attorney. A power of attorney can be a good option if you are physically unable to look after your affairs due to travel or injury.

|

"I want to spend the summer visiting my grandchildren in France. I'll be gone for several months, and I'd like to enable my niece to pay my bills while I'm away. I learned I can do that by making a power of attorney that is limited. In it, I authorized my niece to access my bank account only to deposit my pension cheques and pay my bills, and only until I come home from my trip." – Helga, Victoria |

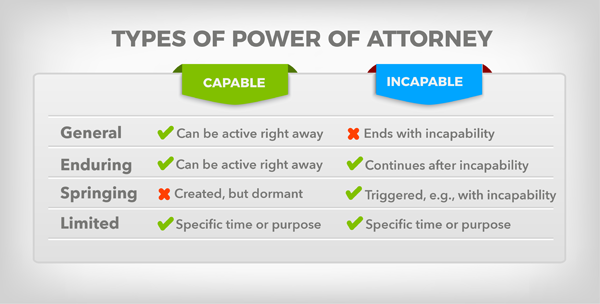

A power of attorney enabling someone to look after your affairs while you are traveling would be an example of a limited power of attorney. This is also called a "specific power of attorney". Your attorney’s powers are limited to a specific task or a specific period of time. For example, you give someone power of attorney to sign the papers on the sale of your home while you’re out of the country on vacation.

It can help if you become mentally incapable

|

"My husband William had an accident at work. He is in hospital in a coma. We have a joint bank account, so I can pay the bills. But our car is in William’s name and the insurance is due. William can’t sign. I wish William had made an enduring power of attorney appointing me as attorney. That way I could renew the insurance." – Anita, Burnaby |

Another reason you might make a power of attorney is to prepare for the chance you become mentally incapable due to age, accident or illness. With an enduring power of attorney, you can name someone to act on your behalf for financial and legal affairs, and make the appointment continue in effect—or endure—if you become incapable of making decisions. (With a "general power of attorney", the appointment ends if you become mentally incapable.)

See the section "Enduring Power of Attorney" for more on this type of power of attorney.

A power of attorney can also be set up to come into effect only when something happens to trigger it. This is called a springing power of attorney. You can appoint someone to act on your behalf if the triggering event happens. The triggering event can be if you become mentally incapable. For example, the appointment can be worded to come into effect “when two physicians have determined that I am no longer capable of managing my affairs”. Such a springing power of attorney is not active until you are incapable.

The types of power of attorney are not mutually exclusive. For example, an enduring power of attorney or a springing power of attorney can be limited to a specific purpose or time period.

For health care and personal care decisions, there are other planning options

A power of attorney deals only with your financial and legal affairs. It does not enable your attorney to make decisions about your health care and personal care. For example, a power of attorney would not allow your attorney to consent to surgery on your behalf or to make decisions about where you will live.

Under BC law, if you want to have someone of your choice make decisions about your health care and personal care when you no longer can, you can make a representation agreement. In a representation agreement, you name a "representative" to make health and personal care decisions for you, or assist you in making decisions. You can name whoever you want as your representative—a friend, relative, spouse, or adult child.

Another option for health care planning is an advance directive. It allows you to write instructions to your health care provider about what kind of health care treatment you want and don’t want, including life support or life-prolonging medical interventions. No one will be asked to make a decision for you when the advance directive applies.

|

With a “section 7 representation agreement”, your representative can be authorized to handle “routine management” of financial affairs and most legal matters, in addition to health care and personal care. This would allow them to pay your bills, deposit your pension and other income, and make investments for you. However, they can not handle financial matters beyond the routine, such as buy or sell your real estate or take out a new loan in your name. See Nidus Personal Planning Resource Centre for more on representation agreements. |

By planning, you will make things much easier for your loved ones

If you become incapable of making decisions independently, and you do not have an enduring power of attorney or another planning tool in place, your loved ones may need to go to court to get the legal authority to handle your affairs. This is called getting "committeeship". Going to court is an expensive and time-consuming process. There is no guarantee the court will decide to grant the legal powers asked for.

An enduring power of attorney is the most common way to ensure the person of your choice is able to step into your shoes and handle your finances if you become incapable of doing so.

But there are other planning options to be aware of.

In a trust agreement, you can put all your property and income in a trust. You can name someone of your choice to be the trustee, and spell out terms of how the property is to be managed. The trust continues if you become incapable. It can even survive death, ensuring that your affairs continue to be managed in a way that is consistent with the terms in the trust.

If your finances are not complicated, a pension trusteeship can be an option. Let’s say your income is limited to federal income security programs such as Old Age Security and the Canada Pension Plan, and your expenses are just rent, food and utilities. A capable family member or friend can sign up with the income security programs to receive your pension funds as trustee to pay the rent and bills.

If your income is directly deposited into your bank account, you could set up a joint bank account with a trusted relation or friend. That person could help you with paying bills and making withdrawals. (A joint bank account introduces some risks that other planning options don't. For example, any person named on the joint account is able to withdraw money at any time. As well, if one of the account holders dies, the surviving account holder becomes the owner of the account.)

The time to make a power of attorney

If you become incapable of making decisions independently, it is too late to make a power of attorney. You have to plan ahead and do it in advance.

In considering personal planning options, be aware there are different "legal capacity" requirements. Legal capacity refers to a person’s ability to make binding decisions or agreements.

Someone who doesn’t have the legal capacity to make an enduring power of attorney may still be able to make a representation agreement. A person can make a "section 7 representation agreement" even if they cannot manage their routine financial affairs or look after their daily needs. This makes a section 7 representation agreement a very useful “last resort’’ document when someone has not made any planning documents and they are starting to lose their capacity.

|

A lawyer or notary public can guide you on which planning documents best fit your situation. See the "Where to Get Help" section for help finding a legal professional to work with. |

If you decide to make a power of attorney, see the steps involved in "Making a Power of Attorney" and the unique considerations when making an enduring power of attorney.

| ||||||||||||||||||||